How is the Federal Tax Credit Calculated?

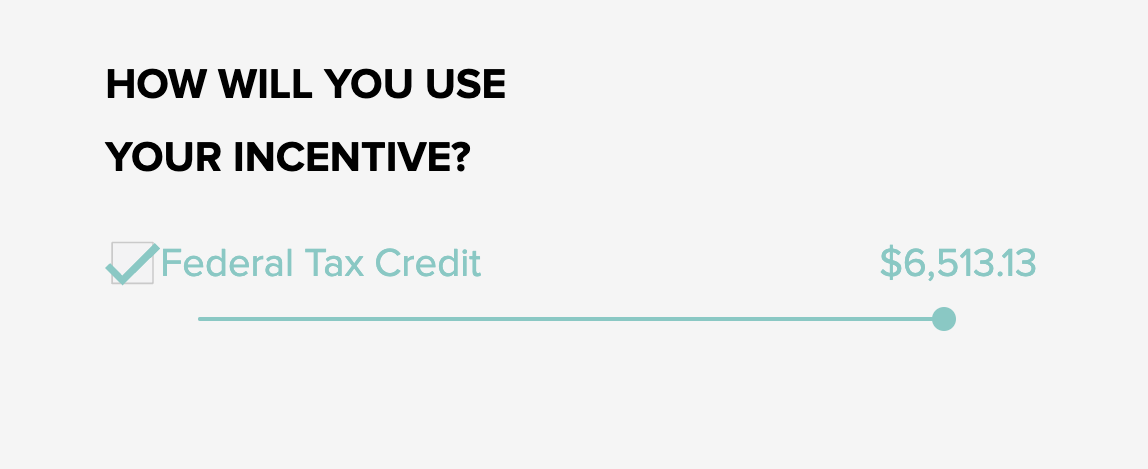

The federal government gives customers purchasing solar a 30% tax credit that can be applied after their loan reamortizes (if they are not paying cash, otherwise it just applies to the cash payment). This number is found by taking 30% of the final system cost:

0.3 x Final System Cost = Federal Tax Credit

It is sometimes called the Investment Tax Credit (ITC) or Federal Tax Credit (FTC).